What is a Retirement Calculator?

A Retirement Calculator is a valuable tool for anyone who has ever wondered “How much money do I need to retire comfortably?”

Its main purpose is to help people better plan their finances so they can hit their retirement goals and not have to worry about their monthly expenses once they leave the workforce.

A Retirement Calculator requires some basic information such as:

- An individual’s current age

- Pre-tax income

- How much of their income goes to retirement savings

- How much they currently have in their retirement fund

- When they plan to retire

Using these personal details, it can quickly estimate how much an individual’s retirement savings will be once they reach their desired retirement age.

Different types of Retirement Calculators can also answer lots of other important questions about retirement and financial planning such as:

- How much should I save for retirement?

- How long will my retirement savings last?

- What is my monthly budget when I retire?

- Am I on the right track to a comfortable retirement?

- How much do I need to retire early?

- When can I retire?

The answers to these retirement questions largely depend on how a Retirement Calculator is designed and what equations it uses.

How Does a Retirement Calculator Work?

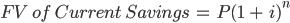

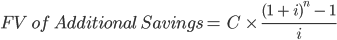

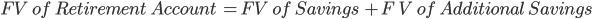

Retirement Calculators do much more than simply add up the money that’s set aside for retirement over several years.

A properly managed retirement portfolio should grow exponentially over the years through the power of compound interest. But this is also offset by the negative effects that inflation will put on a retirement fund’s purchasing power as the years go by.

For example, NerdWallet’s Retirement Calculator makes the following assumptions:

- A 5% rate of return once you hit retirement

- An average inflation rate of 3%

- A 2% annual salary increase

These figures are based on historical averages and do an adequate job of projecting the growth of a retirement fund.

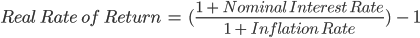

A 5% rate of return is pretty conservative. If we factor in the average inflation rate of 3%, we end up with a Real Rate of Return of roughly 2%.