What is a Home Affordability Calculator?

A Home Affordability Calculator is more than just a standard mortgage or loan payment calculator. Also known as a Mortgage Affordability Calculator, its main goal is to help people answer the question “How much house can I afford?”

Similar to a regular mortgage calculator, it requires users to input some basic information about a loan, such as:

- Down payment amount

- Interest rate

- Loan term or length of the loan (in years)

But the results that these two types of mortgage loan calculators produce offer different perspectives on the home-buying experience.

A mortgage calculator uses the loan/financial information mentioned above to estimate how much the monthly payment will be depending on how big of a loan (the price of the house minus the down payment) a person is willing to take out.

But home buying is not as simple as saving up for a downpayment and making sure your household income can cover the monthly mortgage payments. You also have to make sure that you're not stretching your budget too thinly so you can still live a relatively comfortable life — and that you’re not setting yourself up for a lifetime of debt or end up being house poor.

You should have money left over after paying off your monthly mortgage and other financial obligations (debt, bills, and household expenses) for unplanned expenses and retirement savings.

A Home Affordability Calculator helps people answer important questions lots of home buyers are thinking about such as:

- How much mortgage can I afford?

- How expensive of a house can I afford?

It does this by evaluating a person’s income against all the additional costs involved in home buying and homeownership.

A Home Affordability Calculator will typically require the following financial details from the home buyer:

- Household income

- Total debt (car payments, personal loans, credit card debt, student loans, etc.)

- Property taxes

- Home insurance

- HOA fees

- Closing costs

Once these numbers are plugged into the calculator, it will show you:

- How big your monthly mortgage payment should be

- The typical home prices you should be looking at during your house hunting

- How much mortgage you can get approved for

How Does a Home Affordability Calculator Work?

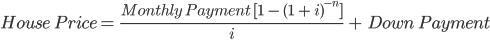

Home Affordability Calculators use Debt-to-Income (DTI) ratio to determine what a person’s monthly mortgage payment should ideally be. Using this estimated monthly payment, it can then calculate the price of the houses someone should be looking at after factoring in the down payment, interest rates, and the length of the mortgage.

Debt-to-Income ratio simply shows how much of a household’s or an individual’s total monthly income goes to debt payments.

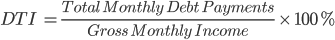

Calculating for DTI is fairly easy. Just add up all the monthly debt payments and divide it by the gross monthly income, then multiply it by 100%.